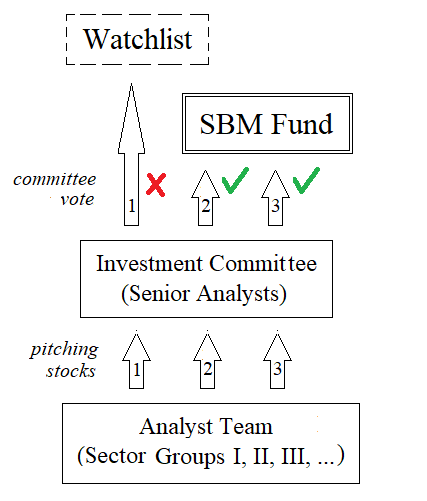

Team Structure

Becoming an analyst will generally be the first role that students are involved when joining the SBM fund. You will support our team in finding investible stocks and conducting thorough due diligence using industry and company analysis, while receiving training in the process by senior analysts. Each new team member can select one or two industry sectors to specialize in, with the goal of developing deeper expertise and potentially leading a group of sector analysts. Senior analysts can qualify to become a committee member who is making investment decisions.