Imagine you are a wealthy merchant in the year 1600, with some extra money in your treasury but unsure where to invest it. The British East India Company (EIC) and the Dutch East India Company (VOC), two of the first multinational enterprises (MNEs) founded at the turn of the 16th century, would have been perfect investment opportunities. However, you couldn’t buy stocks just yet. In 1602, the Amsterdam Stock Exchange (AEX) opened and still functions today. There, you could buy shares of the VOC and invest in the international spice, slave, and drug trades. Although risky, these highly profitable international investments often outperformed domestic investments in Britain and Holland. These companies were pioneers of Foreign Direct Investment (FDI). Naturally, you decide to invest! Risky endeavors often yield substantial profits, and eureka –

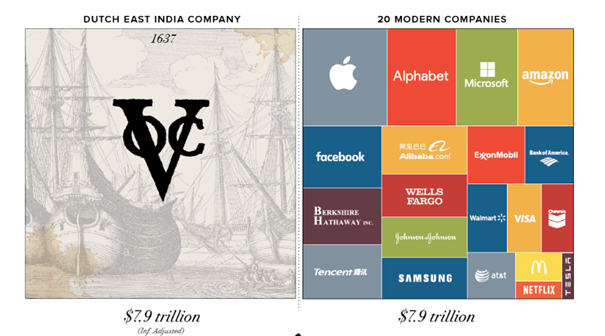

By 1637, 35 years after the initial public offering (IPO), the Dutch East India Company had reached a market capitalization of 78 million Dutch guilders, equivalent to 7.9 trillion USD in modern terms. You are now a very happy merchant. Not surprisingly, despite similar military equipment and soldier training, the VOC and EIC leveraged their competitive advantages in governmental and economic structures—capitalistic empires versus feudal kingdoms—to gain monopolies in what are now India, Bangladesh, Hong Kong, Pakistan, Malaysia, and Vietnam.

In 1612, the East India Company clashed with the Portuguese. Notably, this was a commercial organization with its own powerful army and navy. That year, the company’s fleet defeated the Portuguese at the Battle of Swally. It was a fierce conflict: the English fought with nearly four times fewer ships but won through advanced tactics. Having gained supremacy, they established themselves on the Indian subcontinent. Between 1612 and 1647, the company had already established 23 trading posts in India, gradually penetrating the region. However, Portuguese remained strong and did not allow for British monopoly yet, creating a competitive market. Therefore, everything seemed fine for the Indians until 1668 when the British made an agreement with the Portuguese, when the monopoly was established.

King Charles II Stuart married the Portuguese princess Catherine of Braganza, and as part of her dowry, the island of Bombay was leased to the British. A British trading post was established at the mouth of the Ulhas River, strategically located on an important water trade route. This strong outpost marked the beginning of the company’s military presence in India. Although disliked by the locals, the British defeated the Bengali forces at Plassey in 1757 under Robert Clive, and then inflicted another heavy defeat in 1764, gaining direct control over Bengal, Orissa, and Bihar. By 1818, primarily through the efforts of the East India Company, Britain controlled the main territories south of the Sutlej River. The first governor of Bengal was Robert Clive, the hero of the Battle of Plassey, who was promoted from colonel to general and given a baronial title. From Bengal, he extracted valuables amounting to 5 million 260 thousand pounds sterling through direct contributions.

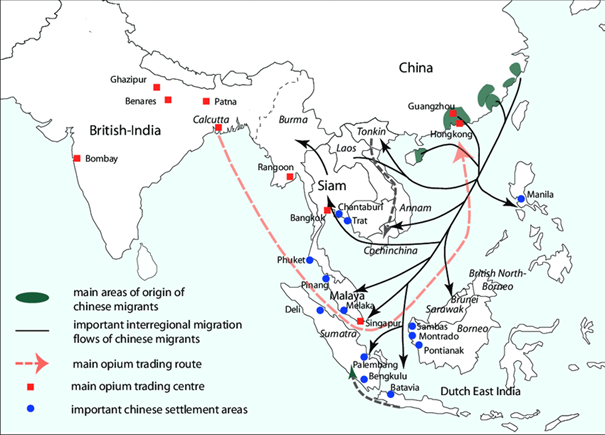

Robert Clive’s success was contagious. Monopolies, including yours, issued low prices on export goods from India and China, much lower than equilibrium prices. Europeans disliked the variable costs and damaged goods on the long trips to Asia. You do not want your goods to spoil, do you? Ships had to travel for around seven months from London to India, with the main issue being the large African continent. Tea carriers struggled to keep their cargo fresh—tea leaves absorbed smells and lost value each day of the voyage. Later, with technological advancements and industrialization, the “Clipper” was created. This fast-traveling ship could reach India from Britain in approximately 100 days. These sleek vessels, with their towering masts and billowing sails, represented not just a mode of transport but a symbol of British naval prowess during the 19th century. One of the most famous and beautiful ships was the legendary “Cutty Sark,” named after a young witch from Robert Burns’ famous epic poem “Tam o’ Shanter.” The ship was built on the River Leven, Dumbarton, Scotland, in 1869 for the Jock Willis Shipping Line. Merchants, greedy for profits, used Clippers in a very profitable scheme. For example, goods would be transported to Calcutta, sold in China, and then tea bought in China at low monopolistic prices would be sold in Britain again—a perfect trading cycle. Repeat it for decades, reap the profits, and become rich. Of course, you would do it, right?

Not surprisingly, Britain became wealthy alongside you! However, the inhuman exploitation led to the direct extraction of national wealth. Even British sirs, lords, and the educated populace called it the “Wealth Drain,” believing that Indians and other natives were simply less worthy to live than British elites. For you and other elite members, the Clippers embodied a paradox of their time—symbols of technological advancement and commercial success, yet also vessels embroiled in the complex geopolitics and ethical dilemmas of colonial expansion. They sailed across oceans, driven by the winds of profit and empire, leaving a wake that echoes through history as a testament to both human ingenuity and the darker facets of global trade.

The darker aspects of colonial trade are highlighted by economist Utsa Patnaik, who claims that the British drained 45 trillion USD (in 2017 prices) out of India between 1765 and 1938. Ultimately, the EIC led to the creation of the British Raj, marking the colonization of India by the British. The British imposed taxes, rules, monopolistic prices, slavery, and the import of cheap cotton. These activities rapidly degraded both crafts and agriculture, leading to famine. Bengal experienced its first famine in 1769-1770, with consequences that are almost impossible to quantify due to the lack of records, but estimates range around 5 million people. Subsequent famines occurred regularly: in 1783, 1866, 1873, 1892, 1897, and finally in 1943-44, with horrific photographs from the last famine spreading worldwide.

Moving forward in the timeline, the British Secretary of State for India, Leopold Charles Maurice Stennett Amery, had a conversation with Winston Churchill about the famine issue. In his diary, Amery recorded Churchill’s words: “I hate Indians. They are a beastly people with a beastly religion. They are responsible for the famine because they breed like rabbits.” Notably, this was a diary entry, meaning personal notes not initially intended for publication, suggesting Churchill indeed said something like this as he had no reason to hold back in a private conversation with a respected colleague. Churchill also remarked around the same time, during the famine: “At least we have not had a population of Indians as reliable as they have been protected from the horrors of the Second World War.” And to think it all started with a simple investment opportunity with an attractive 30% return on investment.

Moreover, the “beautiful” legacy of colonialism still exists. Jardine Matheson Holdings Limited, a company that got rich during colonial times from the sale of opium and tea. Could the founders be your children, they might have managed your capital well! Now, It is a Hong Kong-based, Bermuda-domiciled British multinational conglomerate. The Jardine and Matheson company was well known for its skills in smuggling opium and quickly expanded to further sectors of the economy due to its rapid growth, based on drugs and millions of human lives. Nowadays, it is possible to rent a room in one of the company’s hotels and enjoy.

Next time we will explore more about the companies that made their names and collected capital in colonial times, the ancestors of FDI in the 17th century.